When you are just at the beginning of your career, there are many things that come in your priority list of what you want to do with your earnings. With the newfound financial freedom, we dream of buying everything we have ever wanted and then chart out our plans to actually get them. Savings and investments, however, usually don’t feature very high up on that list. This is exactly why we carried out a small survey to find out more about the importance of savings and investments in a young woman’s priority list. Before we get into our findings, here’s what you need to know –

- We shared a questionnaire with our participants to record their answers

- 57 percent of the women belonged to the age group of 18 to 29 years; 33 percent were from 30 to 39 years; 10 percent were 50 and above

- All of the women started their first jobs at or before the age of 25

- All quotes have been included after consent from the survey participants

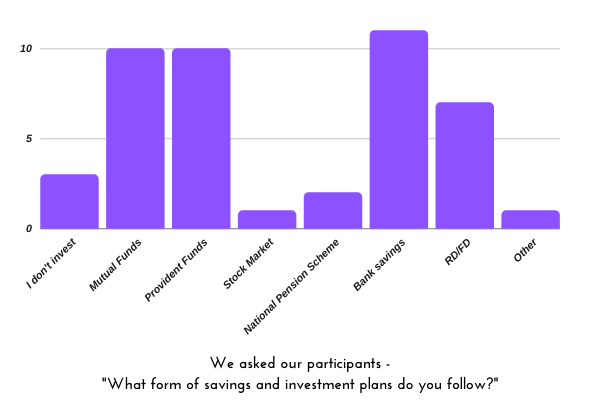

Source: Survey Form

Why are savings and investments important?

Most young people look at savings as a part of their income which they can’t use. In reality, however, savings are that part of an individual’s income which will come in handy to bail them out of tough situations in future. Taking the current scenario as an instance, architect Mona Kohinoor says, “COVID-19 is the best example today… So many employees across the world, who have been unpaid for the past three months, are surviving on past savings only.”

Tanvi Bansal, a Sales Incentives Operations Analyst, explained it further by talking about how savings not only help in financial emergencies but are also a great way to avoid going into debt. “I am personally not comfortable with debt. I believe even if I want something which costs a huge amount, I should be able to pay and not put that on a credit card,” she said. “If I have savings, I can even go on an unplanned vacation without getting worked up about the finances,” she added.

Related: How To Save Money And Invest On A Beginner’s Salary In India

For someone who struggles to save, how can they trick themselves to start?

Source: Survey Form

We asked our participants about the best ways to trick oneself to start saving, if it is a new habit that they are trying to inculcate. Associate Designer Diksha Hans recommends starting small and beginning with studying and learning about it. Apoorva, a Lead Design Engineer, on the other hand, gave more emphasis on regularity when it comes to saving, irrespective of the percentage.

Tanvi Bansal believes the best way to start saving is through a ‘bit by bit’ approach. Starting a small recurring deposit, she says, works well for beginners where “you wouldn’t even notice the money is gone, but, in net, you might have saved at least some, if not a lot.” Another brilliant tactic, according to Tanvi, is to have a savings account with automated monthly deposits from the salary account. The savings in such accounts often feel like “the money you found in the pocket of old jeans,” she adds. And, of course, for a more dedicated approach, investing in systematic investment plans (SIPs) is simply the way to go!

Related: Wondering How To Save Money? Try Kakeibo, The Japanese Art Of Managing Your Finances

As young people starting their first jobs, saving and investing can seem like something that can wait. However, here’s one thing that must be remembered:

Contingencies and tough situations don’t knock on your door for a suitable timing; they just arrive without notice.

Ridhi, a banking professional, puts it across beautifully.

Think about being stuck in a situation where you have nothing, you lose a job, you don’t have savings – what will you do then? How long will people support you? Think about that and then work towards finding your solution to it.

Thoughts?

Web Stories

Web Stories