Budgeting – it may seem like a scary word, but it is an essential part of your financial independence. It’s difficult to earn money, but it’s just as easy to spend it all. First-time earners are usually so excited about getting their own paycheck and being able to pay for their needs that they tend to spend it all. Without a budget, it is very difficult to make plans for the future or save or grow your money. So, whether you are a first-time earner or someone who has been earning for a while but has no budget, this is a simplified guide to making your money work for you.

Related: How To Save Money And Invest On A Beginner’s Salary In India

1. Figure out your net income

Before you create a budget, you need to know how much money you get in hand and what amount you have to work with. Make a list of all your income sources, be it your job, any freelance projects, or even regular money you receive from your parents. If you are a freelancer or a small business owner, the money you make each month is likely to be inconsistent. So, keep detailed notes of what you make each month. Make an average of three months of pay and use that as the baseline for making your budget. This is the first step of budgeting for beginners and others alike.

2. Track your monthly expenses

Make a list of all your expenses in a month. This should include your fixed expenses like rent, mortgage, loans, and investments as well as your variable expenses like grocery, utilities, or subscriptions. Write them down in a diary or use an app to track your expenses. Some easy-to-use expense tracking apps are Moneyfy, Goodbudget, Wallet, and FinArt which will be helpful for beginners who are starting their budgeting journey.

3. Set a realistic financial goal

Once you have your income and expenses in one place, set a goal for yourself on how to spend that money. Don’t set an unachievable goal like saving for your retirement in just three months. You need to make short-term and long-term goals. Short-term goals will include saving money for a trip you are planning or paying off your debts. Your short-term goals will be something you wish to achieve in one to three years. Your long-term goals would be saving for retirement and saving for your potential kids’ future and this will be a decades-long process.

4. Find a budget model that works for you

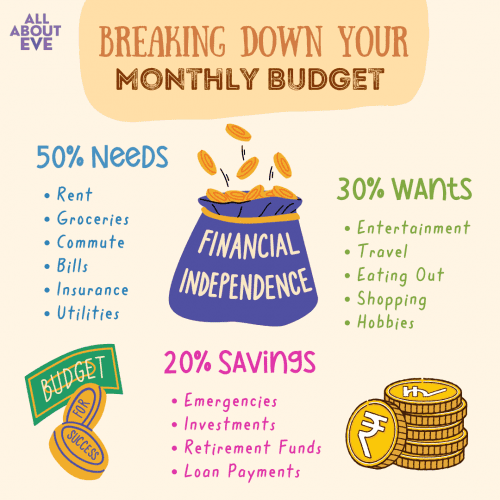

There are various budget models you can follow. The easiest budget model for beginners to follow is the 50/30/20 model. In this model, you set aside 50 per cent of your income for your needs like rent, bills, utilities, insurance, etc. Thirty per cent of your income will be spent on wants like shopping, eating out, or your hobbies. The remaining 20 per cent will go into your savings, which could be your investments, retirement funds, recurring deposits, or loan payments. For example, if your take-home income is ₹30,000 per month, this is what your budget should look like. ₹15,000 will be spent on your needs, ₹9,000 will be spent on your wants, and the remaining ₹6,000 will go into your savings.

Another budget model to follow is zero-based budgeting wherein you budget everything down to the last rupee. So, if you earn ₹30,000 per month, you need to account for every single rupee in it so that there is no money wasted or left over.

Yet another budgeting model is cash envelope budgeting. You will need to create different envelopes for every need and want and assign a particular amount for each envelope. So, you will have an envelope for rent, groceries, bills and utilities, entertainment, savings, etc. You can’t go beyond the budget you have set for each envelope. So, if you spend everything in one envelope, you can’t spend anything else for that category in the month.

The idea of creating a budget is to make it easier for you to handle your money. So, choose a budget model that works for you and not one that you would want to spend too much time worrying over.

Related: Wondering How To Save Money? Try Kakeibo, The Japanese Art Of Managing Your Finances

5. Stick to your budget

Making a budget is not the end of the game, you actually need to stick with it. Budgets can feel restrictive as you have a limit on spending. You can adjust that by making some room in your “fun money”. You can tweak your budget to fit all your expenses in a month, but it is important to stick to your set budget. The best way to do that is to track your expenses regularly and see if you are on track or going overboard. Pay with cash if you feel you are a little loose-handed while paying with your card or UPI. Additionally, do a monthly review of your budget to figure out if your expenses and income have changed. Like anything else you do in life, sticking to a budget also requires some commitment and determination. So, learn to budget when you are a beginner instead of waiting too long.

6. Adjust your spending to stay on track

Taking a close look at your expenses and seeing if you are overspending anywhere is a key rule of budgeting for beginners. If you are, adjust your spending to stay on track with your budget. Take a look at your wants to see if you can adjust something or absolutely chuck it out of the list. Instead of going out for a movie, see if you can watch a movie at home, or instead of going out for dinner or lunch, why don’t you try a new recipe at home? In the case of buying groceries, look for a cheaper alternative. Instead of getting your groceries online, go to your local vendor or a wholesale market where groceries tend to be cheaper. The aim is to alter your spending to give you maximum savings.

Featured Image Source

Related: 5 Financial Influencers You Need To Follow On Instagram To Grow Your Money

Web Stories

Web Stories